estate tax changes in reconciliation bill

What tax hikes are in the social policy and climate change bill that Democrats are trying to pass by year-end. This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/TENLMGYUWNJ4XKLUX6YKYVJ26M.jpg)

U S Senate Democrats Agree To 3 5 Trln For Budget Reconciliation Bill Reuters

2021 Reconciliation Bill.

. Congressional Democrats are still wrangling among themselves over what provisions or tax law changes are or arent in the formerly 35 trillion Build Back Better bill. Estate is 21000000 Exemption 5300000. Daniel Troy D-Willowick is.

The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. 13 released the draft text of their proposed tax-raising provisions which was the subject of a. And even though the legislation is still subject to change there are proposed.

Tuesday October 5 2021. Gift in 2021 of 11000000. Potential Tax Changes With the 2022 Fiscal Year Federal Budget deadline of October 1 st rapidly approaching House Democrats presented a preliminary tax proposal targeting high earners wealthy estates and corporations to fund Bidens proposed 35 trillion infrastructure spending package.

Update - Tax Proposals of the House Ways and Means Committee. Major tax changes in draft reconciliation bill. Last month the House Ways Means Committee.

The estate tax exemption would be reduced as of January 1 2022 from its current 117 million to 5 million adjusted for inflation. Ad Estate Trust Tax Services. Estate Tax 15700000 x 40 6280000.

The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else. The draft legislation was expected to be included in a larger budget reconciliation bill but as of. House of Representatives introduced a reconciliation bill that includes significant changes to estate gift and generation-skipping tax laws.

And backers of the proposal said its time to make changes to the tax break. USA October 1 2021. It depends what day it is.

As the budget reconciliation bill goes up for a final Senate vote real estate partnerships should be evaluating how to adjust to the potential tax changes. Instead it contains three primary changes affecting estate and gift taxes. On November 1 2021 the House Rules Committee reported out the Build Back Better Act Reconciliation Bill which leaves out most.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. At the same time the bill would raise taxes substantially. Estate and gift tax exemption.

The latest version a. Under EGTRRA the estate tax exemption rose from 675000 in 2001 to 35 million in 2009 and the rate fell from 55 to 45. The many changes floated since the presidential and congressional elections of 2020 would have reduced the.

2 days agoTheres a bipartisan bill in the Ohio Legislature that would update and change Ohios homestead tax exemption for senior citizens. This preliminary analysis is still available here. Thursday 04 November 2021.

Five Tax Implications of the Budget Reconciliation Bill for Retirement Savers. Reconciliation Bill to Target Trusts Estates and the Wealthy. The amended change would raise the cap to 80000 from 2021-2030 and revert back to 10000 for 2031.

Growth and Tax Relief Reconciliation Act of 2001 EGTRRA. Revised Build Back Better Bill Excludes Major Estate Tax Proposals In late October the House Rules Committee released a revised version of the proposed Build Back Better Act Reconciliation Bill. Estate is 10000000 Exemption 0.

In 2010 the estate tax was eliminated. Estate Tax 10000000 X 40 4000000. The expiration of the current laws estate tax exemption 24 million for married taxpayers would be accelerated by the House billcurrently it.

The latest draft of the US Congress budget reconciliation Bill omits most of the previously proposed tax changes that would have affected US estate planning. Trust Estate Strategies Protected in New Tax Proposal November 15 2021 The new reconciliation bill that was introduced in the House of Representatives eliminates some of the more significant tax changes that were proposed in the original bill approved by the House Ways Means Committee in September. This means the current inflation-adjusted exemption of 11700000 per person would be reduced to approximately 6000000.

Most of the major proposals that would create substantial changes in the estate planning arena were not included. Estate planning changes dropped from US budget reconciliation Bill. The tax bill dropped Monday by Democrats on the House Ways Means Committee includes an array of changes to estate assets trusts corporate taxes and business deductions.

107-16 among other tax cuts provided for a gradual reduction and elimination of the estate tax. As negotiations over spending and taxes in a potential budget reconciliation bill tentatively the Build Back Better Act are ongoing in Congress Democrats on the House Ways and Means Committee on Sept. The Infrastructure Bill passed the House and President Biden signed it into law on November 15th yet Congress continues to debate the repayment details of the Budget Reconciliation Bills provisions.

At this writing President Biden is in Rome for the G20 Summit to be followed by the UN Climate Change Summit in Glasgow. Here are some changes the budget reconciliation tax law would bring about. Estate Tax 15000000 X 40 6000000.

If the bill becomes law. Learn How EY Can Help. All major provisions of the House Ways Means Committees budget reconciliation tax bill would cut 2022 taxes on average for households making 200000 or less.

Gift in 2021 of 0. Uncertainty makes tax and estate planning more challenging. On September 27 the US.

Is on at least some changes to tax law that will have widespread impact on many Americans. Death in 2022. Estate is 16000000 Exemption 1000000.

Biden Reconciliation Bill Faces Senate Land Mines The Hill

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

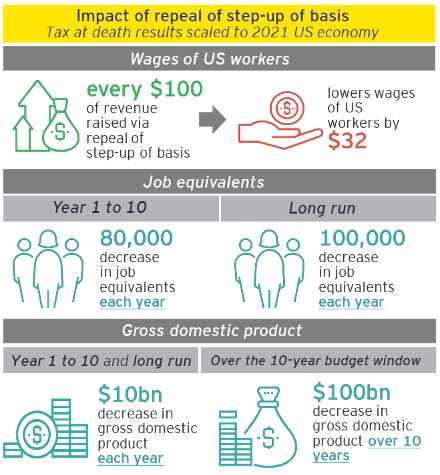

Study Dems Supercharged Second Death Tax Kills At Least 800 000 Jobs Slashes Paychecks Ways And Means Republicans

Hiltzik Biden S Budget Reconciliation Bill And Climate Change Los Angeles Times

The Democrats Have A Lot Of Cutting To Do The New York Times

Everything In The House Democrats Budget Bill The New York Times

More Than 12 Billion In Lihtc Provisions And Nearly 6 Billion For Neighborhood Homes Tax Credits In Nov 3 Draft Of The Build Back Better Reconciliation Bill Would Finance Close To 1

On Reconciliation Bill Senate Moderates Hide Behind Joe Manchin And Kyrsten Sinema Wsj

Everything In The House Democrats Budget Bill The New York Times

Higher Tax Rates For Billionaires And Corporations Can Still Fund Biden S Agenda

/cdn.vox-cdn.com/uploads/chorus_asset/file/22766964/GettyImages_1332557833_copy.jpg)

Why Biden And The Senate Democrats Budget Reconciliation Plan Would Be A Big Deal Vox

Five Tax Implications Of The Budget Reconciliation Bill For Retirees Wealth Management

The Democrats Have A Lot Of Cutting To Do The New York Times

Senate Draft Of Build Back Better Reconciliation Bill Currently Stalled By Sen Manchin Would Finance Nearly 1 Million Affordable Homes Over 10 Years Novogradac

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

More Than 12 Billion In Lihtc Provisions And Nearly 6 Billion For Neighborhood Homes Tax Credits In Nov 3 Draft Of The Build Back Better Reconciliation Bill Would Finance Close To 1

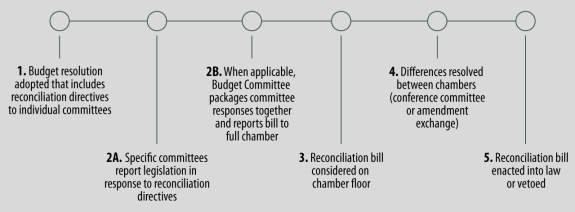

The Budget Reconciliation Process Stages Of Consideration Everycrsreport Com

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

Why Democrats 3 5 Trillion Reconciliation Bill Is A Losing Game The Hill